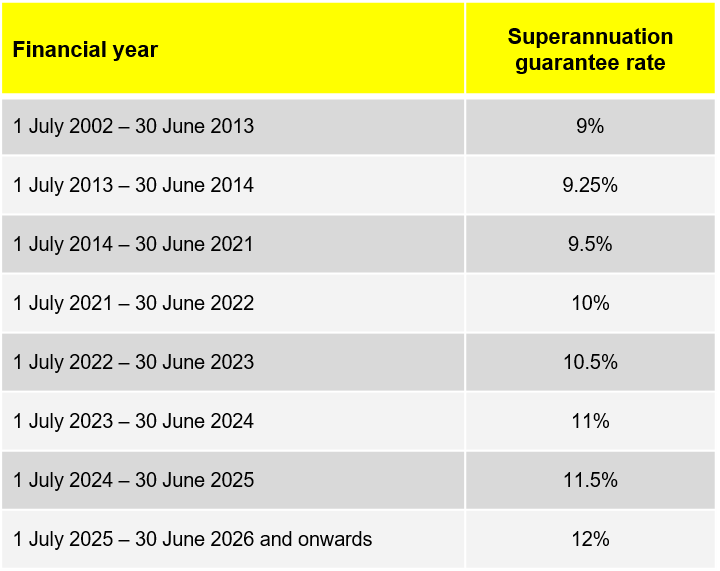

For 2023 – 2024 the maximum superannuation contribution base is $62,270 per quarter. So if an employee’s earnings exceed $62,270 for the quarter, you do not need to pay SG contributions on their earnings above this limit. Note: Employers may be required to contribute above these limits under any industrial awards or workplace agreements in place.. Prior to 1 July 2023, your total super balance needed to be below $1.48 million for you to be able to contribute the full three years of annual caps ($330,000) under the bring-forward rule. On 1 July 2023, this threshold increased to $1.68 million. If your total super balance is above this limit, your ability to bring forward future year caps.

Superannuation Pre 30 June Considerations and Opportunities Cooper Partners

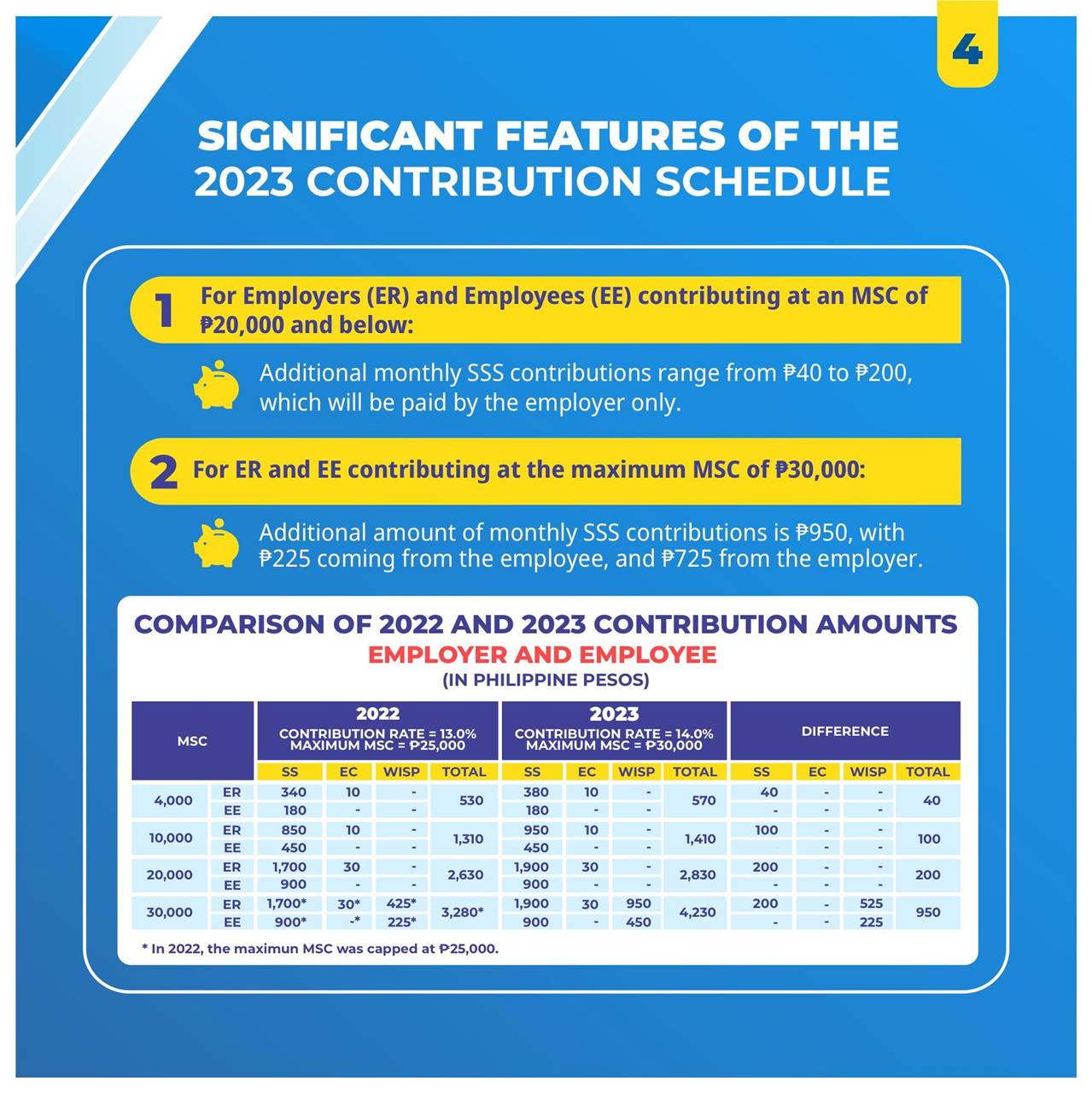

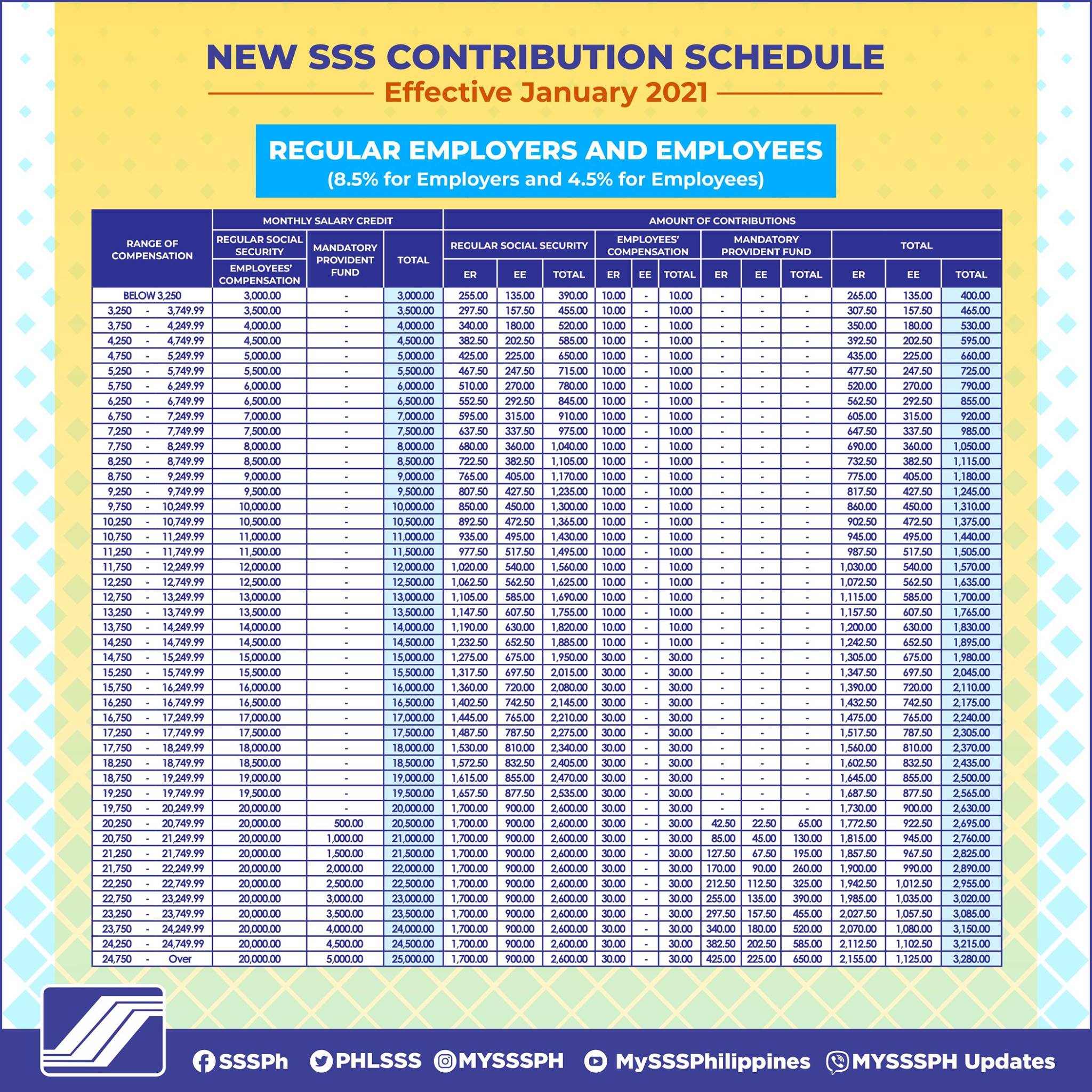

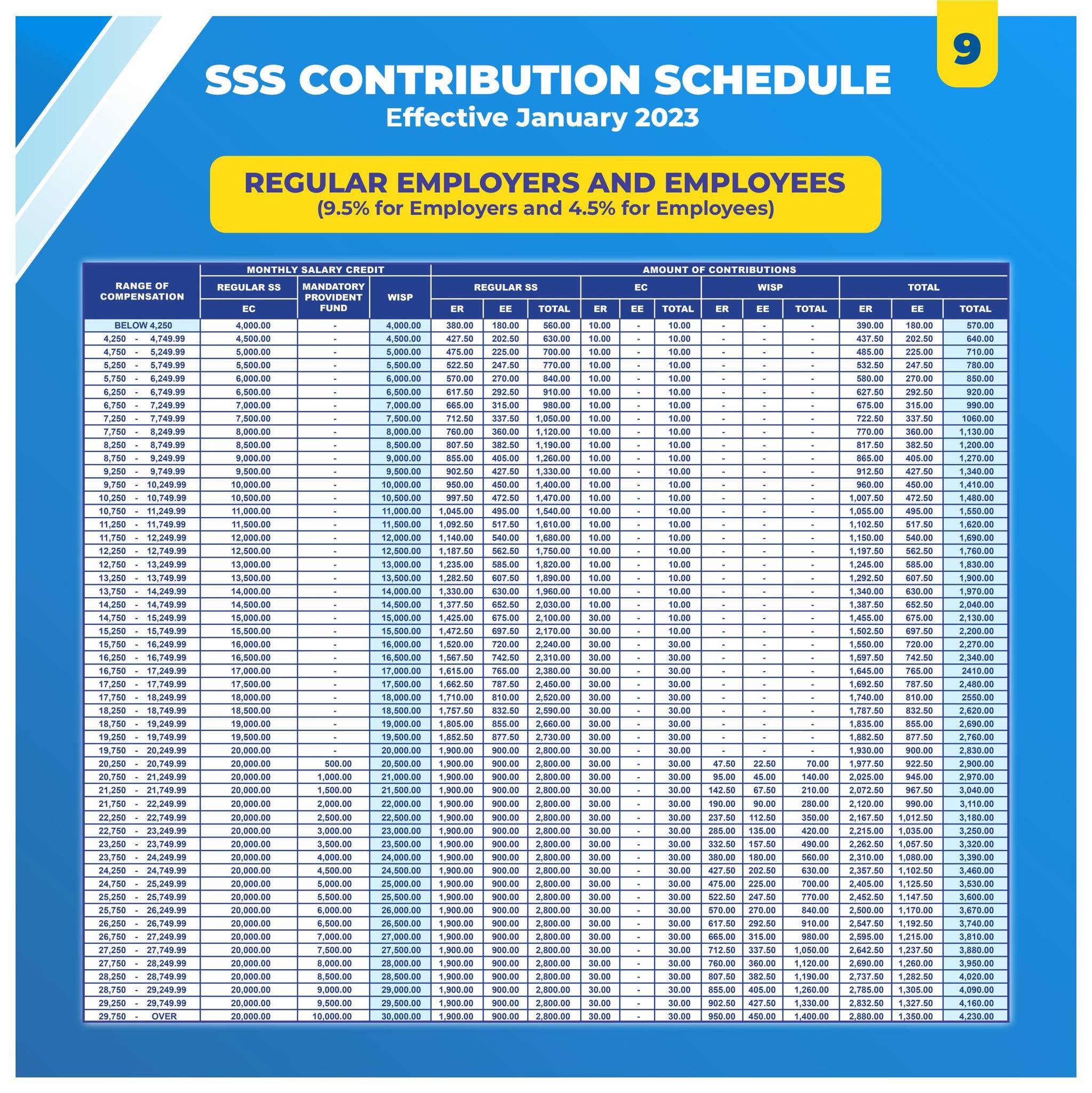

2023 SSS Contribution Table and Schedule of Payment The Pinoy OFW

401k 2022 contribution limit chart Choosing Your Gold IRA

401k 2024 Contribution Limit Chart

IRS Announces 2023 HSA Contribution Limits

New SSS Contribution Table 2023 (Everything you need to know) SSS Answers

12+ Hsa 2023 Contribution Limit Irs For You 2023 GDS

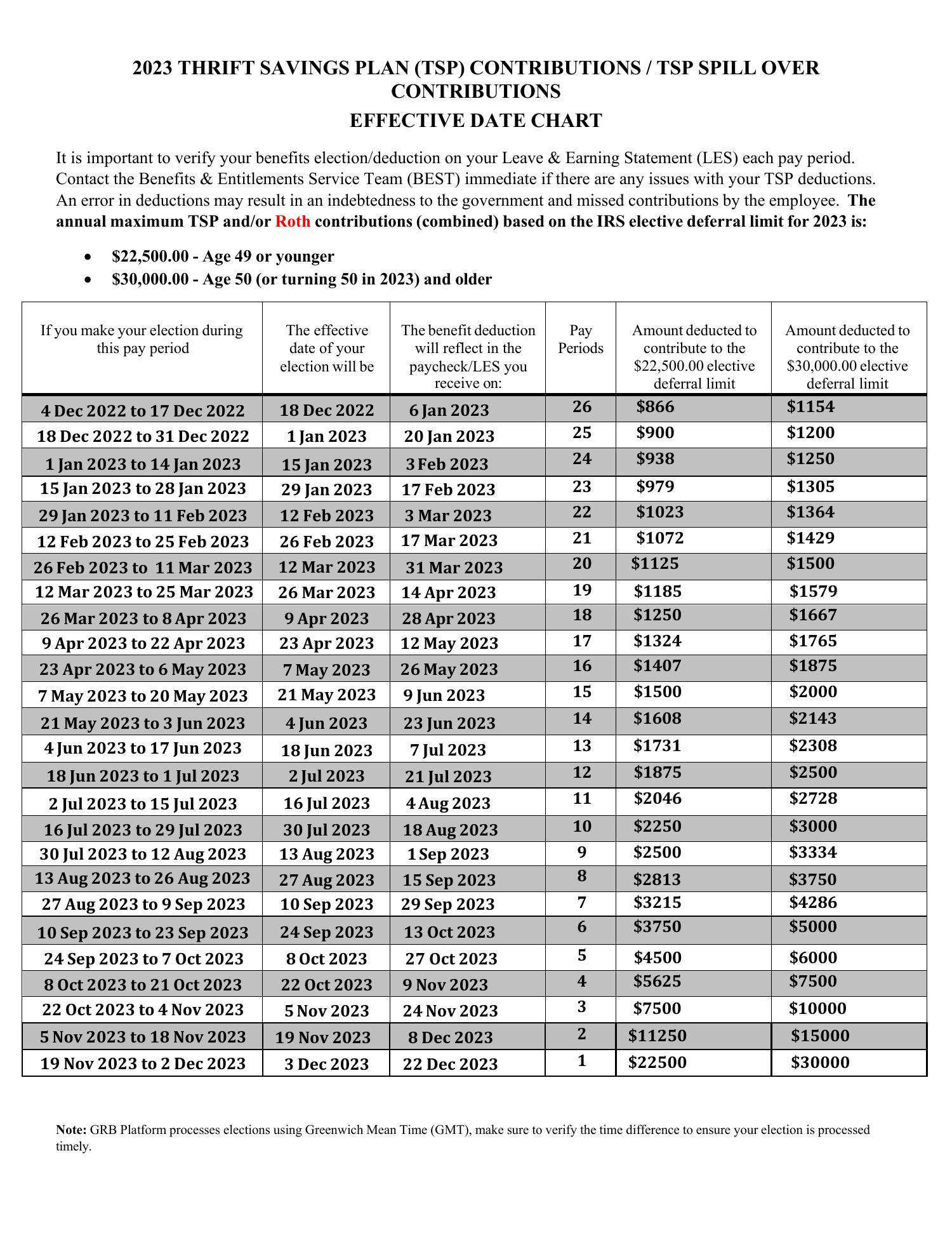

2023 TSP Contributions and Effective Date Chart.pdf DocDroid

Annual Retirement Plan Contribution Limits For 2023 Social(K)

SSS Contribution Table 2023 Here’s Guide on Members Monthly Contributions Based on

Increase to employer super contribution rate Walsh Accountants

New sss contribution table 2023 Artofit

Ss 2022 Payment Schedule

What you need to know about the 3 Million Dollar Super Contribution Cap 2023 Precision Wealth

New Schedule of Social Security (SS) Contributions for Employers (ERs) and Employees (EEs

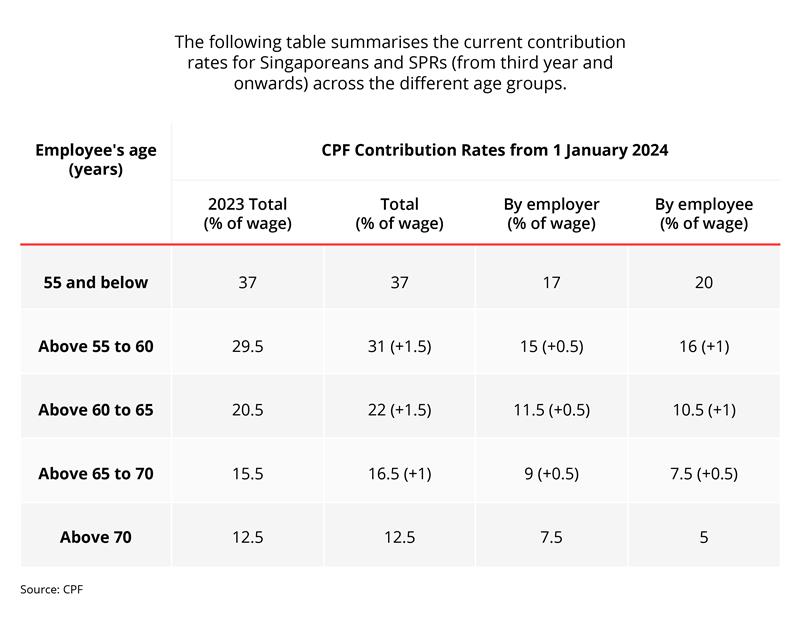

Save more with CPF and SRS DBS Singapore

New SSS Contribution Table 2023 Schedule Effective January

Maximum Defined Contribution 2024 Sandy Cornelia

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog

The super guarantee charge (SGC) applies when employers don’t pay the minimum amount of super guarantee (SG) for their eligible employees to the correct fund by the due date.. 30 June 2023. 10.50. 7. 1 July 2023 – 30 June 2024. 11.00. 8. 1 July 2024 – 30 June 2025. 11.50. 9.. The maximum super contribution base is used to determine.. There is a maximum amount of earnings for each employee for which you are required to pay SG. This is known as the maximum contribution base and for the 2023/24 financial year, it is $62,270 a quarter. For more on calculating the maximum contribution base, visit ato.gov.au Give your employees a choice of super fund